parker county tax assessment

Learn how county government serves you. TAX RATE INFORMATION.

Law Amends Property Assessed Clean Energy Pace Programs In Virginia Jd Supra Assessment Renewable Energy Energy

The Assessor may be reelected without limit.

. Our local school systems are financed through the collection of property taxes on the basis of Value as appraised by the Parker County Appraisal District PCAD. 167 of home value Yearly median tax in Parker County The median property tax in Parker County Texas is 2461 per year for a home worth the median value of 147100. Serves as president of the Property Tax Assessment.

Ad Pay Your Taxes Bill Online with doxo. Inheritance tax appraiser for the county. 817 596 0077 Phone 817 613 8092Fax The Parker County Tax Assessors Office is located in Weatherford Texas.

The County Assessor is a statutory officer of the county elected for a four year term. Find Tax Records including. Welcome to the website of the Parker County Appraisal District.

The office of the county treasurer was established in the Texas constitution in 1846. Parker property tax records. 2022 State of the Town Breakfast.

The same is true of our county roads community colleges regional hospital districts EMS districts volunteer fire departments in the form of subsidies and many other services too. We Provide Homeowner Data Including Property Tax Liens Deeds More. Or call 817458-9848 to receive alerts.

For comparison the median home value in Parker County is 14710000. Tax Records include property tax assessments property appraisals and income tax records. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Parker County Tax Appraisers office.

Weatherford TX 76086 Parker County Assessor Phone Number 817 598-6139 Parker County Assessors Website httpwwwcoparkertxusipscmscountyofficestaxAssessorCollectorhtml Additional Parker County Information Property Tax Information. Parker County collects on average 167 of a propertys assessed fair market value as property tax. Parker County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Parker County Texas.

Gain Quick Access To The Records You Need In Any City. Effective tax rate Parker County 00161 of Asessed Home Value Texas 00180 of Asessed Home Value National 00114 of Asessed Home Value Median real estate taxes paid Parker County 3452 Texas 3099 National 2471 Median home value Parker County 214200 Texas 172500 National 217500 Median income Parker County 77503 Texas 61874. Ad Uncover Available Property Tax Data By Searching Any Address.

The median property tax also known as real estate tax in Parker County is 246100 per year based on a median home value of 14710000 and a median effective property tax rate of 167 of property value. Registration Renewals License Plates and Registration Stickers Vehicle Title Transfers Change of Address on Motor Vehicle Records Non-fee License Plates such as Purple Heart and Disabled Veterans License Plates Disabled Parking Placards. Create an Account - Increase your productivity customize your experience and engage in information you care about.

Greater Parker Foundation. Parker County Texas Property Tax Go To Different County 246100 Avg. Oversees a general reassessment in the county.

County tax assessor-collector offices provide most vehicle title and registration services including. Get Emergency Alerts from Parker County. These records can include Parker County property tax assessments and.

Parker County collects very high property taxes and is among the top 25 of counties in the United States ranked. The Parker County Property Appraiser is responsible for determining the taxable value of each piece of real estate which the Tax Assessor will use to determine the owed property tax. Development Requirements Information.

Name Parker County Assessors Office Suggest Edit Address 1112 Santa Fe Drive Weatherford Texas 76086 Phone 817-598-6139 Fax 817-598-6133. Just Enter Name and State. Banker for Parker County government working with departments and public for receiving and disbursing funds including general payments of county expenses payments for jury duty election workers and payroll.

Parker County Assessors Office Contact Information Address Phone Number and Fax Number for Parker County Assessors Office an Assessor Office at Santa Fe Drive Weatherford TX. Registration Renewals License Plates and Registration Stickers Vehicle Title Transfers Change of Address on Motor Vehicle Records Non-fee License Plates such as Purple Heart and Disabled Veterans License Plates Disabled Parking Placards. Ad Find Records For Any City In Any State By Visiting Our Official Website Today.

Parker County Assessor Address Parker County Tax Assessor - Collector 1112 Santa Fe Dr. Get Emergency Alerts from Parker County. For more information for businesses regarding about sales tax and licensing requirements in Parker visit our Sales Tax Division page.

County tax assessor-collector offices provide most vehicle title and registration services including. The Parke County Assessor is responsible for the following functions. Property Taxes Tickets etc.

See what Parker County has to offer. Within this site you will find general information about the District and the ad valorem property tax system in Texas as well as information regarding specific properties within the district. Certain Tax Records are considered public record which means they are available to the public while some Tax Records are only available with a Freedom of Information Act FOIA request.

Property Tax Calculation Boulder County

Travis County Texas Property Search And Interactive Gis Map

What Property Owners Need To Know About Homestead Savings Runnels Central Appraisal District Official Website

How Much Is The Property Tax In Round Rock Texas Quora

The Property Management Module Lets You Centrally Store Track And Maintain Information And Documentation F Property Management Management Facility Management

A Guide To Your Property Tax Bill Alachua County Tax Collector

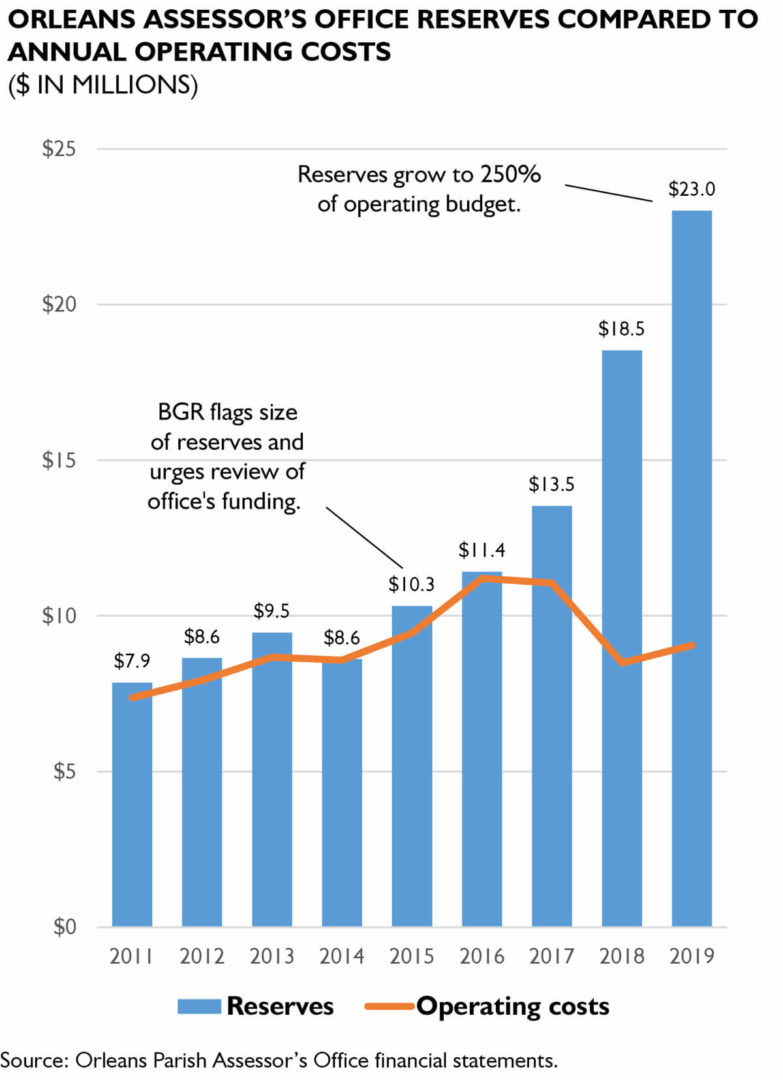

Policywatch Revisiting Assessment Issues In New Orleans

Policywatch Revisiting Assessment Issues In New Orleans

Get Best Tax Return Services At Affordable Prices Weaccountax Is A Leading Accountancy Firm For Financial Services In Income Tax Return Tax Return Income Tax

Why Are Texas Property Taxes So High Home Tax Solutions

Tax Assessor Chester Township Nj

Search Pay Property Taxes Polk County Tax Collector

Neighboring Landowners In State Land States Genealogy Tip Of The Day Genealogy Map Family History Genealogy

Financial Risk Assessment Template New Financial Risk Assessment Template Illwfo Schedule Template Guided Reading Lesson Plans Internal Audit